Acorns: Invest For Your Future

Acorns: Invest For Your Future App Info

-

App Name

Acorns: Invest For Your Future

-

Price

Free

-

Developer

Acorns

-

Category

Finance -

Updated

2026-03-02

-

Version

4.182.0

Introducing Acorns: Invest For Your Future

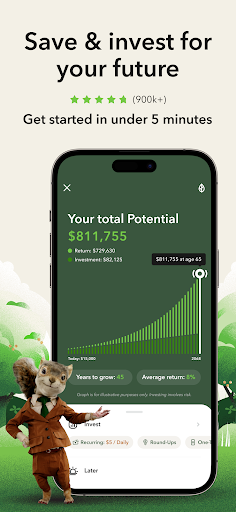

Acorns is a user-friendly micro-investing platform designed to make investing accessible and effortless for everyone, especially those just starting their journey towards financial growth. Developed by leading fintech innovators, Acorns simplifies the process of investing by automatically rounding up everyday purchases into diversified portfolios, transforming small savings into a pathway for building wealth over time.

Core Features That Make Acorns Stand Out

Automatic Round-Ups & Recurring Investments

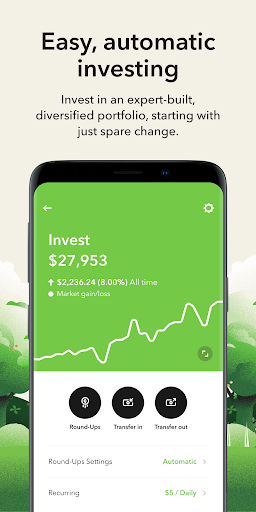

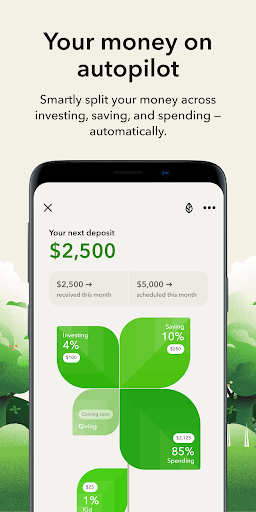

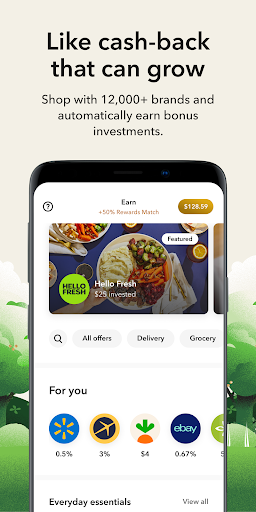

Imagine turning your daily coffee runs and grocery trips into investment contributions without even noticing. Acorns' hallmark feature seamlessly rounds up your purchase amounts to the nearest dollar and invests the spare change into diversified portfolios. Additionally, users can set up recurring deposits, making consistent investing a habit rather than a chore. This automatic approach lowers the barrier for entry, turning small, manageable amounts into a meaningful investment pool.

Smart Portfolio Management

Powered by intelligent algorithms, Acorns offers a range of diversified portfolios tailored to your risk profile and financial goals. Whether you're a cautious saver or an aggressive investor, the app's algorithms automatically rebalance your investments to optimize growth and minimize risk. This intelligent management ensures that investors are always aligned with their comfort levels and long-term objectives, making investing less about manual oversight and more about strategic growth.

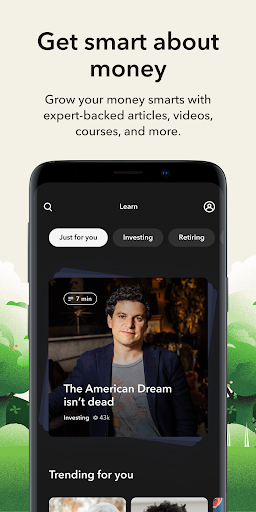

Financial Education & Personalized Insights

Acorns isn't just about investing; it also aims to empower users through bite-sized educational content and personalized insights. From tips on saving money to updates on your portfolio's performance, Acorns keeps users engaged and informed. This educational aspect is particularly valuable for beginners, giving them confidence to understand market movements and investment principles at their own pace.

User Experience and Design: Smooth Sailing for New Investors

From the moment you open Acorns, the interface feels inviting—clear, clean, and intuitive, much like having a friendly financial advisor by your side. The onboarding process is straightforward, guiding first-time users through setting up their account, selecting risk levels, and customizing preferences with minimal fuss. Navigating between account balances, investment options, and educational content is fluid, thanks to well-thought-out menus and responsive design.

The app's operation is impressively smooth; transitions are seamless, and investment execution feels swift and reliable, providing peace of mind for users who want their money working for them without delays. For users new to investing, the learning curve is gentle—intuitive prompts, simple language, and helpful tips make grasping the basics easy.

Unique Selling Points: Security and Transaction Experience

Compared to traditional finance apps, Acorns's standout features hinge on robust security measures and a thoughtful transaction process. The app employs bank-level encryption and multi-factor authentication, ensuring your personal data and funds are well-protected. Additionally, because transactions are automatically rounded up and processed in the background, they feel almost invisible—like a gentle, yet persistent, gardener tending to your financial garden without overwhelming you.

Another notable aspect is how Acorns streamlines the investment process. Unlike some apps where you might experience cumbersome manual entries or delays, Acorns's automated round-ups and recurring investments occur instantly, encouraging consistent contributions without the hassle. This frictionless transaction experience removes many typical pain points associated with managing investments via mobile, enhancing user trust and satisfaction.

Should You Make Acorns Your Investment Companion?

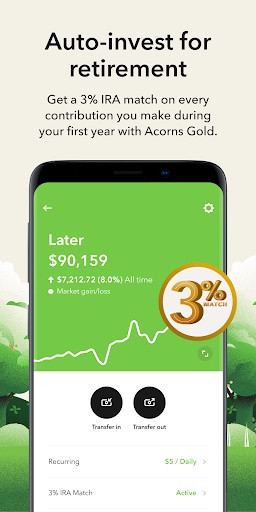

For those who are just dipping their toes into investing or those seeking a passive, automated way to grow their savings, Acorns is a commendable choice. Its core strengths—automatic micro-investments, smart portfolio management, and user-friendly design—make it especially suitable for beginners or busy individuals who prefer their financial growth to be as effortless as possible.

However, experienced investors seeking complex asset management, personalized financial planning, or advanced trading features might find Acorns somewhat limited. Nonetheless, for the target demographic, it offers an excellent combination of simplicity, security, and educational value.

In summary, I recommend Acorns as a reliable, beginner-friendly stepping stone into the world of investing. Its most distinctive feature—automatic round-ups—is akin to turning everyday spending into a quiet, steady investment flow, which elegantly embodies the idea that small steps can lead to significant financial progress over time. For anyone looking to start their investment journey with ease and confidence, Acorns deserves a dedicated look.

Pros

User-friendly interface

The app features an intuitive design that makes investing accessible for beginners.

Automatic round-ups and recurring investments

Seamlessly helps users grow their investments by rounding up everyday purchases and setting up regular deposits.

Diversified portfolio options

Offers various investment portfolios tailored to different risk tolerances and financial goals.

Educational resources

Provides easy-to-understand learning materials to help users improve their financial literacy.

Low minimum investment

Allows users to start investing with as little as $5, lowering the entry barrier.

Cons

Limited investment options (impact: Medium)

Currently focuses mainly on ETFs, which may restrict portfolio diversification for advanced investors.

Higher fees for premium features (impact: Low)

Premium plans can be costly compared to similar apps, but more affordable tiers are available.

Lack of personalized financial advice (impact: Medium)

Automated recommendations are helpful, but personalized advice from a financial advisor is not provided.

Limited international accessibility (impact: High)

Currently available only in the US, so international users cannot access the app's features.

No tax optimization features (impact: Low)

Does not currently offer tools for tax-efficient investing, but this may improve in future updates.

Acorns: Invest For Your Future

Version 4.182.0 Updated 2026-03-02